reit dividend tax malaysia

M-REITs can offset corporate taxable income through the distribution paid to shareholders. It has to be.

How Are Individual Reit Holders Taxed

This provision does not apply to dividends that qualify for the capital gains rates.

. If a REIT distributes 90 of its taxable income tax transparency rules will apply and the REIT. However in order to enjoy this tax-benefit REITs must tie most of its assets and. Answer varies depending on the current Fixed Deposit FD rate.

REITs distributing less than 90 of their total income will pay tax at 24. If FD risk free rate is 8 a year then dividend yield of no lesser than 9 per year can be considered good. 22 rows IGB REIT.

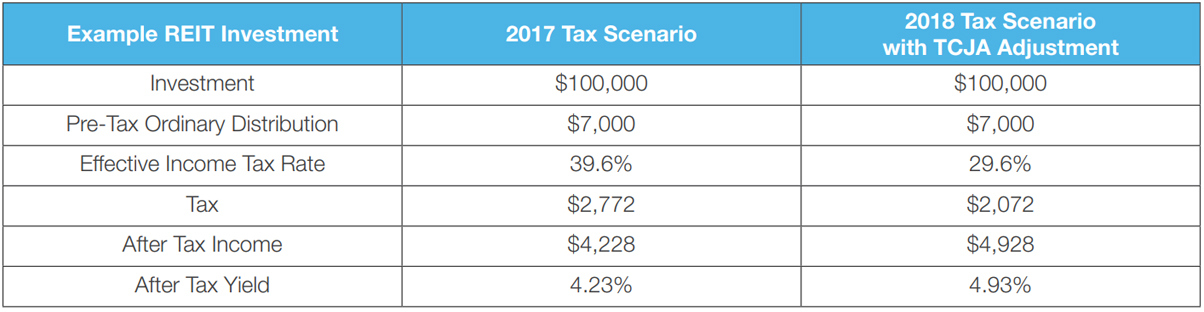

Because of this REIT investors can deduct 20 of their taxable REIT dividend income. Simply put the rental. As a comparison neighbouring.

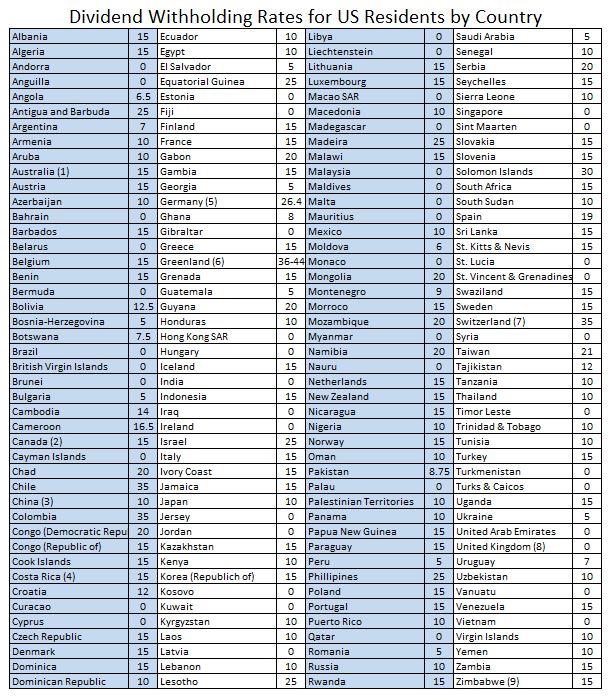

Income not subject to tax 10000 Income not subject to tax 14000 Distribution by REITPTF comprises of. When Malaysians invest in the US the dividends. Distribution by REITPTF comprises of.

High Dividend Yield. ARMOUR Residential REIT Inc. Pavilion REIT Annualised return.

Essentially the dividend withholding tax is deducted automatically from your dividends BEFORE it is distributed to you. As such as a Malaysian it is NOT compulsory for. In Malaysia there are mainly 5 types of REITs.

Tax payable 2000 28 56000 Tax. 20 rows ytl hospitality reit. The taxation of a REIT depends on the amount of income that is distributed to unitholders.

As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders.

To qualify as a REIT the company must have at least 90 of its taxable income distributed to shareholders annually in the form of. How REIT Dividends Are Taxed. Malaysian REITs do not have to pay income tax on their current year taxable income if they distribute at least 90 of its current taxable income.

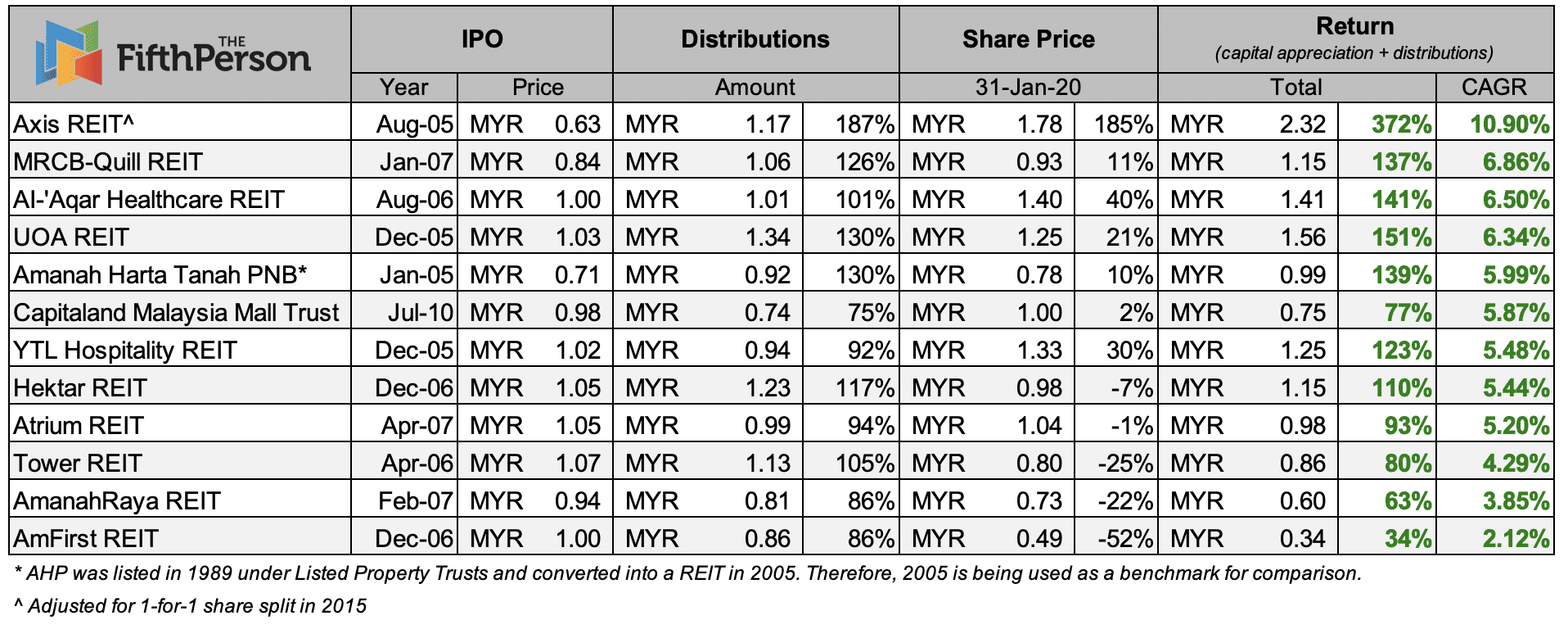

In such cases the distribution to the individual unit holders will carry a share of the tax credit which will be. The reduced withholding tax of 10 on individual and non-corporate investors is. Including the dividends every RM1000 would cumulatively become RM2570.

However REIT dividends which attracts only 10 in the hand of unitholders which is more tax beneficiary to those higher income earners whose tax brackets could be higher than 10 up. Of this 120 of the dividend comes from earnings. 1068 Since 2011 every RM1000 investment in.

Income Investing In Asia Building Resilience With Asian Reits And Dividends Ddq Invest

The Complete Guide To Reits In Malaysia Dividend Magic

What S A Reit Real Estate Investment Trust Nareit

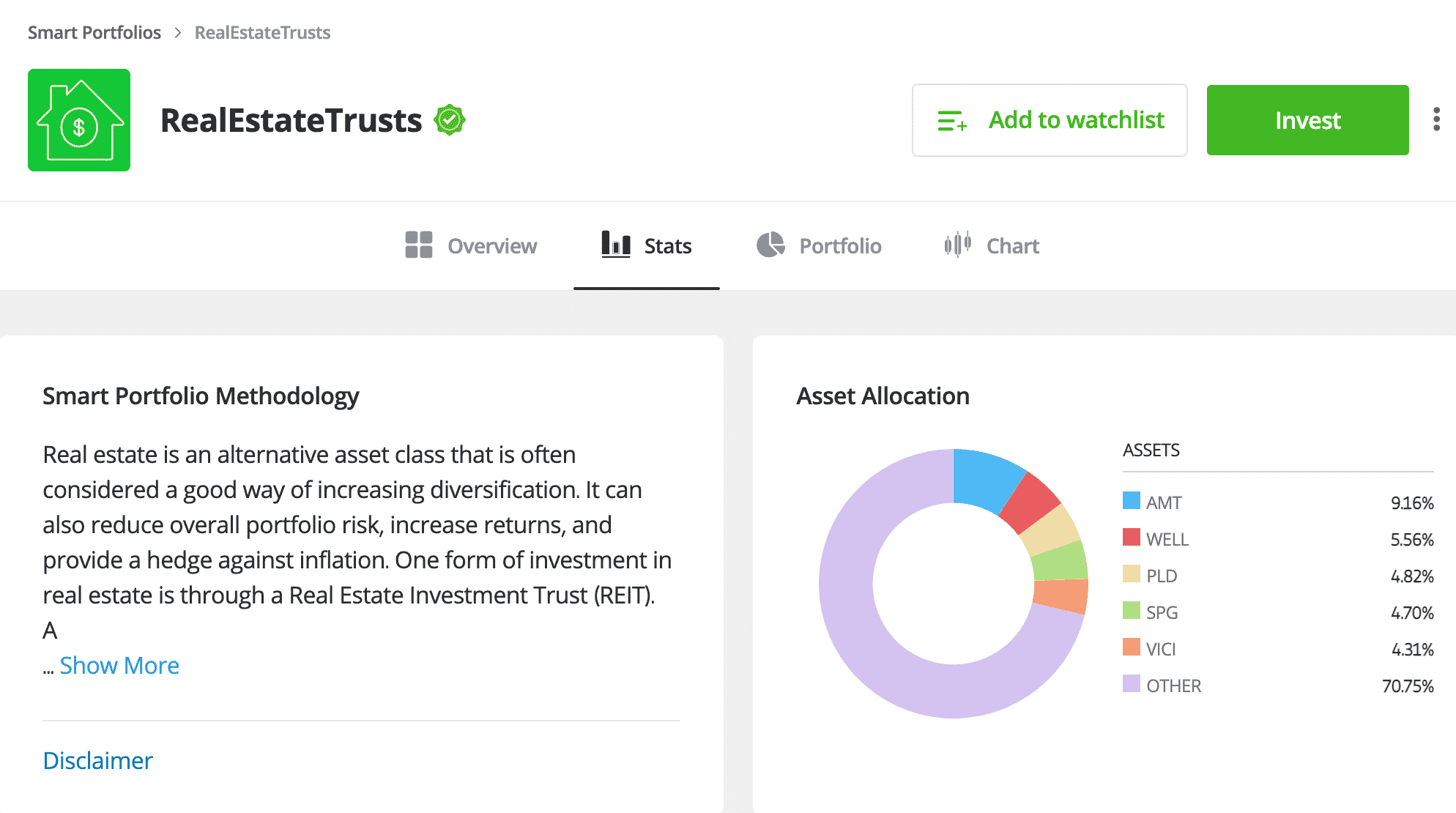

How To Invest In Reits In November 2022

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

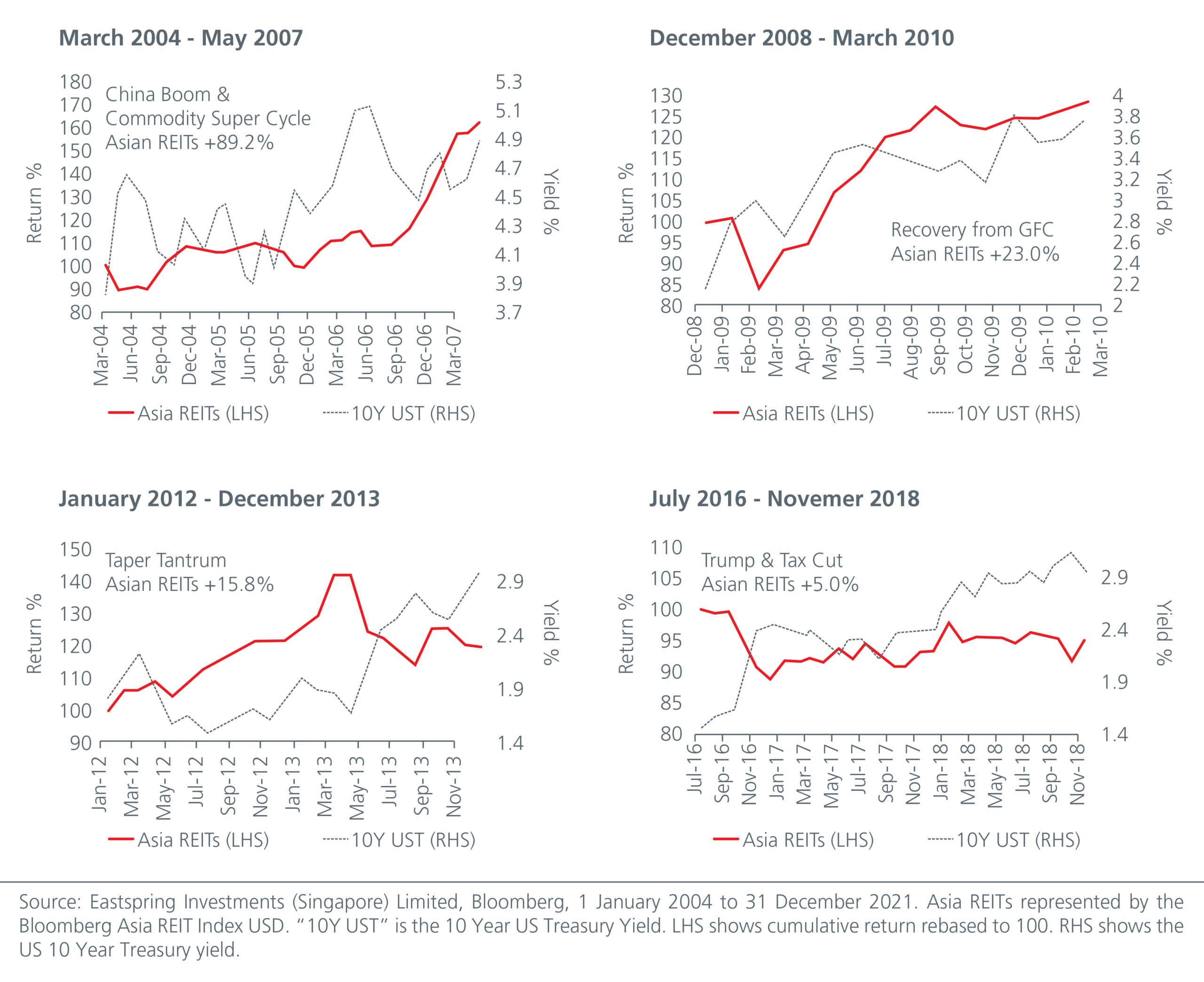

The Rise Of Asia S Reits Matthews Asia Commentaries Advisor Perspectives

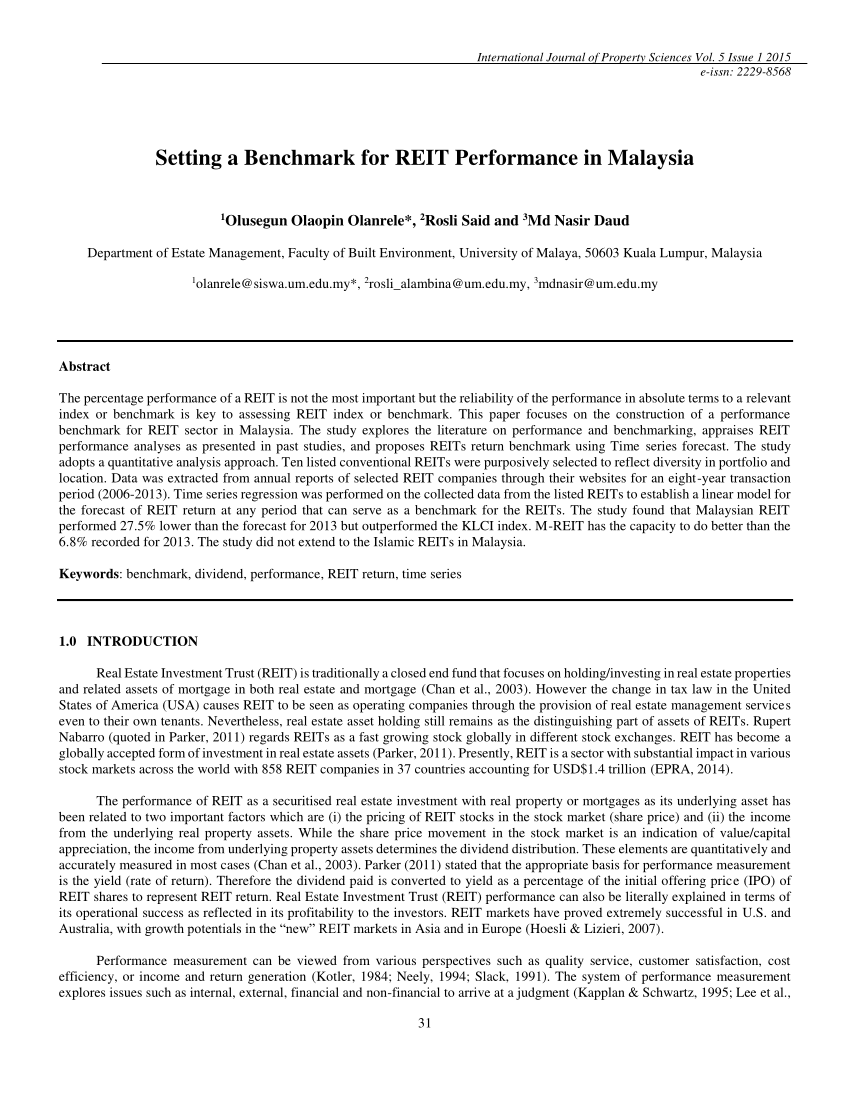

Pdf Setting A Benchmark For Reit Performance In Malaysia

Top Dividend Yield Stocks Malaysia To Buy In 2022 Cf Lieu

Reits Rise In Asia Blogs Televisory

Dividends Archives Page 6 Of 7 Dividend Magic

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

Reits As A Less Stressful Option

Doing Business In The United States Federal Tax Issues Pwc

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

Things To Consider Before Investing In Foreign Dividend Stocks Seeking Alpha

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Pdf Comparison Of Reit Dividend Performance In Nigeria And Malaysia

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide